Challenge

In order to meet various reporting requirements, companies trading on the London Stock Exchange (LSE) were each spending an average of seven man-days per month disclosing corporate governance and social responsibility information to a host of audiences that need this corporate data.

Listed companies have to provide extensive amounts of information for a myriad of disparate parties. Often this information is made available in a number of different, disjointed and duplicated places in order to meet various regulatory mandates. This becomes expensive for companies to maintain in terms of both time and money.

Solution

In June 2004, Priocept was appointed by the LSE to design a new corporate responsibility communications platform for listed companies. Priocept was chosen because of its specialist expertise in internet product development and its reputation for fast and flexible project delivery. Priocept also had a track record of providing high quality IT services to the LSE combined with an understanding of how to apply web and internet technologies to meet the needs of LSE clients.

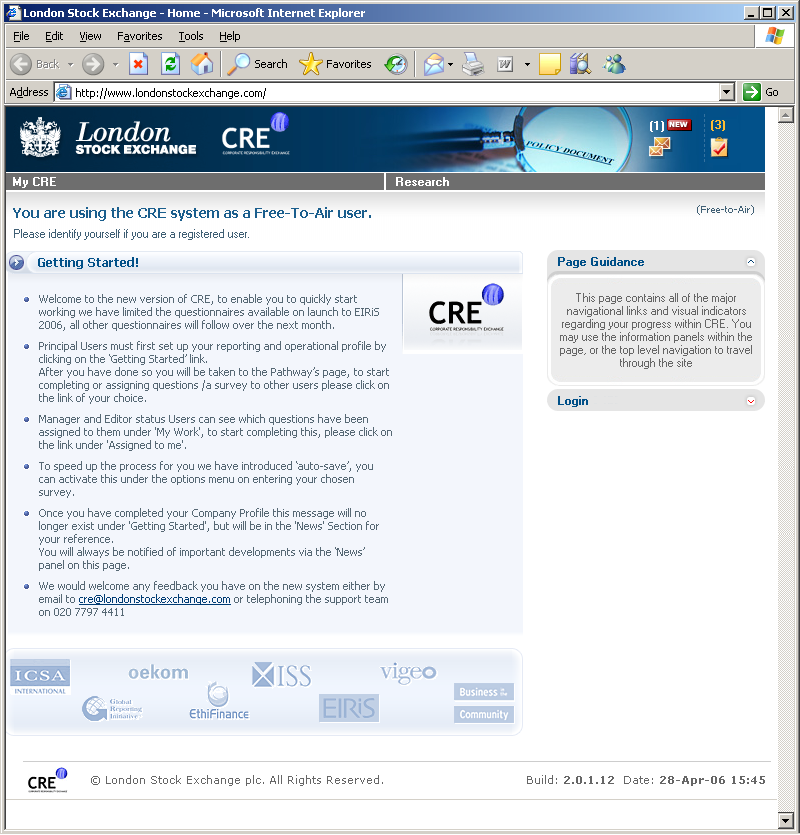

Priocept helped the LSE to design the data architecture and questionnaire system that underpins the Corporate Responsibility Exchange (CRE). This included the development of XML schemas and taxonomies and technical design work to ensure a future migration path to XBRL technologies. The design formed the basis of an open platform for the exchange of corporate governance and corporate social responsibility data.

Fully operational since September 2004, the CRE allows companies to save time by disclosing information only once to an audience of many while meeting varying compliance requisites. The CRE provides analysts, fund managers and research agencies with a better tool for researching companies’ policies and practices in areas of corporate responsibility and governance.

Result

A year on from the creation of the CRE, companies have realised substantial savings in reporting man-hours which translates into significant cost savings each year combined with more timely reporting. Today, 175 companies in the UK, Europe and the US use the CRE and new companies are added almost daily. This includes more than 50 per cent of FTSE 100 companies.

Furthermore, the CRE product provides a foundation upon which other reporting and data sharing efficiencies can be realised as Priocept continues to work with the London Stock Exchange to develop more service enhancements and solutions for listed companies, analysts, fund managers and research agencies.

In November 2005 the LSE launched the CRE in the United States to help public companies there comply with mandatory levels of communication.

People are beating a path to our door. Already more than 100 companies have approached us regarding the launch in the US. The LSE is offering a product that succeeds where others have failed – and this is due in no small part to our partnership with Priocept in conceiving and developing the CRE.

Priocept was later appointed by the LSE to develop a new investor relations product that provides listed companies with a fully managed investor relations web presence delivering share price, regulatory news and company fundamentals data without needing to source third party data feeds and perform complex integration work.